Technical analysts and chartists may consider trading a science, but in reality, it is rather an art. Cryptocurrency trading happens within a volatile space, where prices can unexpectedly move up and down. Millions of rookie investors wade into this space yearly, and due to crypto’s unpredictability, many lose their cash.

This is because most traders aren’t experienced in trading and commit basic mistakes, falling into risky traps when making investment decisions. These errors are often the result of misinformation, confusion, impressionability and impulsivity. However, avoiding these mistakes is way easier than most traders believe.

These cryptocurrency trading errors are common among investors – while they can be easily identified, it’s often tricky for newbie investors to escape them, especially when the stakes are incredibly high.

5 Common Mistakes for Crypto Newbies to Avoid

Every crypto trader should act rationally and strategically when investing to make the most of their crypto experience and increase their chances of winning. Here are some common mistakes crypto newbies should avoid.

Not researching before investing

Like with any other investment, it’s critical to do your research on crypto and the asset you want to invest in. You must also understand the actual market conditions before you get in. This research should include the type of cryptocurrency, its current performance and demand, and its predicted longevity.

You’ll hear a lot of information about crypto, and discerning truth-tellers from hype-salesmen can be challenging. This is why it’s paramount to do your own research and ensure the information you get is trustworthy and reputable.

News articles, Twitter, and YouTube are some reliable websites that can help you start your research. This is one of the most critical steps you should take as an investor, and it will serve you more than anything else throughout your crypto journey.

Not choosing the suitable exchange platform

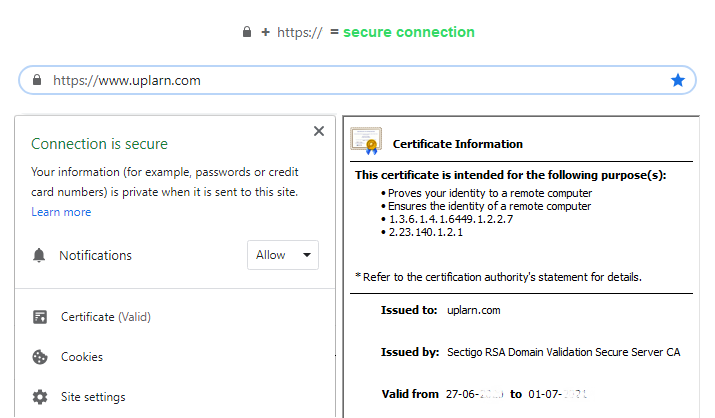

You cannot start trading before choosing a crypto exchange platform. Unfortunately, many newbies rush into this step, which is very costly along the way. Here are some factors to consider when looking for an exchange platform:

- Useful trading features;

- Platform security;

- User-friendliness of the platform;

- Low fees;

- A wide range of cryptocurrencies.

Platform security is imperative, and low fees will save you a lot of money. Also, it’s critical to look for a platform with a user-friendly interface because not all of them have this feature, which can be a significant disadvantage considering that you’re new to the crypto game.

Binance is an example of a suitable platform that includes these essential features. On the platform, you can find popular cryptocurrencies, like Bitcoin and Ethereum and start exploring the crypto world. The platform provides live price data so that you can stay up-to-date on the changes in the market.

For instance, if you want to trade with Ethereum on the Binance platform, you can find a real-time update on the ETH price. You can check ETH price USD today to evaluate the cryptocurrency’s current position in the market.

Letting FOMO cloud your decisions

This is a massive problem in the crypto world and a common mistake many newbies make. But it’s not surprising at all, considering that the Web and social media constitute the crypto market. Many individuals receive information related to crypto from Internet accounts. Social media leads to viral investment fads since many people rally behind a specific cryptocurrency mostly because they follow the herd.

How does FOMO influence your investment decisions? Put simply, you act based on the fear of losing out on an opportunity that seems unique. This often results in selling too early or buying when there are high prices – otherwise, you feel like you’ll miss out on a monumental rise.

Getting rid Of FOMO entirely is challenging, but you can build a trading strategy to combat it. Stick to your plan when the market goes wild – this skill will be very beneficial in the long term.

Also, you should keep in mind opportunities constantly appear in the crypto world, so try not to let FOMO cloud your decisions. Investing isn’t a race – it’s more like a marathon. There will always be another opportunity around the corner, so relax and act smart!

Panic buying/selling

Panic buying/selling is the flipside of FOMO. In the crypto world, price fluctuations are a norm and by no means an exception. Therefore, many crypto newbies panic when they notice prices are dropping, making them over-monitor their portfolios, followed by panic selling to cut their losses.

It’s worth mentioning that you cannot lose a trade unless you sell. Selling when things go wrong may save money, but handling price fluctuations efficiently while committing to your investment goals and limits will benefit you more in the long term.

You should also beware of panic buying. Newbies are often too eager to achieve something more extensive, which can have the opposite effect, as they rush into a trade without even evaluating or researching it.

The key to making long-term profits in cryptocurrency is researching every coin before investing. Let go of the fear of missing out and adopt a slow and steady approach instead.

Putting in more than you afford to lose

Trading, just like other things in life, is a learning experience. Throughout your journey, you’ll inevitably make mistakes and experience losses – most of which will happen at the beginning of your trading career.

With this in mind, here’s a tip if you are a newbie investor: don’t put in more money than you can afford to lose. You should first test the waters with some trades before taking advantage of an extensive trade opportunity that you think can reap considerable profits.

For newbies, getting trading advice from cryptocurrency experts can be genuinely invaluable. This can be only a short conversation about your investment strategy and goals. This is a golden rule in the crypto world – following it helps you keep your emotions out of the decision-making process.

+ There are no comments

Add yours