Fintech apps have revolutionized the way we handle money. They offer secure payments, easy financing, and a range of financial services on our phones. These apps have tools for budgeting, saving, investing, and borrowing money. Here are top fintech apps to consider in 2024.

In the not-so-distant past, the world of finance was synonymous with labyrinthine banks, convoluted financial jargon, and heaps of paperwork. Managing your finances, investing your hard-earned money, or even making a simple payment often felt like traversing a bureaucratic maze.

However, the dawn of the digital age brought with it a financial revolution that has disrupted this traditional landscape and redefined the way we manage, spend, save, and invest our money. At the heart of this transformation are the powerful and innovative tools known as fintech apps.

Fintech, short for financial technology, is a dynamic and evolving industry that leverages technology to improve and streamline financial services. Fintech apps are the crown jewels of this movement, and they have forever altered the financial landscape, putting financial power back into the hands of individuals and businesses.

In this comprehensive blog, we will embark on a journey through the fascinating world of best fintech apps, exploring their evolution, impact, and the remarkable ways they are revolutionizing personal and business finance. From budgeting to investing, from payments to lending, these apps have emerged as indispensable tools for modern-day financial management.

The Fintech Revolution: A Brief History

To understand the significance of fintech apps, it’s essential to grasp the broader context of the fintech revolution. The roots of fintech can be traced back to the late 1950s, with the advent of credit cards and electronic fund transfers. However, it wasn’t until the early 21st century that fintech truly took off, driven by rapid advancements in technology and a desire for greater financial accessibility.

The emergence of smartphones and the proliferation of high-speed internet paved the way for new fintech trends to flourish. These technological enablers allowed developers and entrepreneurs to create a plethora of innovative solutions aimed at democratizing finance.

From peer-to-peer lending platforms to mobile payment apps, fintech started to offer alternatives to traditional banking services. It became evident that fintech had the potential to challenge and, in some cases, surpass the established financial institutions.

The Fintech Revolution

The fintech revolution has turned the financial world on its head, challenging established norms and reshaping the industry from the ground up. These fintech apps represent the vanguard of this financial evolution, each one disrupting a specific aspect of our financial lives. Whether you’re a seasoned investor, a meticulous budgeter, or simply someone who wants to make everyday transactions smoother, there’s a fintech app tailored to meet your unique needs.

The Growing Fintech Ecosystem

One of the most striking aspects of the fintech revolution is its rapid expansion. As the demand for digital financial solutions continues to soar, innovative startups and established financial institutions alike are investing heavily in fintech apps to stay relevant. This burgeoning ecosystem has given rise to a plethora of options, each vying for a spot on your smartphone’s home screen.

Top 10 Best Fintech Apps of 2024

In this comprehensive guide, we’ll explore the best fintech apps that are leading the charge in reshaping the financial landscape.

Robinhood – Empowering Investors

The fintech revolution is reshaping the way we invest, and Robinhood stands at the forefront of this transformation. Founded in 2013, Robinhood’s mission to democratize investing has had a profound impact on how individuals approach the stock market.

- No commission: One of the standout features of Robinhood is its zero-commission model. In the past, trading stocks came with hefty fees that often deterred novice investors. Robinhood changed this by allowing users to buy and sell stocks, ETFs, and cryptocurrencies without incurring any commission charges. This accessibility has opened the doors to investing for a new generation of traders.

- Easy interface: Robinhood’s user-friendly interface has played a pivotal role in attracting users. With a sleek design and intuitive navigation, even those with little to no investment experience can quickly get up to speed. The app provides real-time market data, customizable watchlists, and detailed stock information to help users make informed decisions.

- Financial education: Educational resources are another key feature of Robinhood. The app offers articles and video tutorials to help users understand investing concepts and strategies. This commitment to financial education empowers users to grow their financial literacy as they build their portfolios.

Robinhood isn’t without its controversies, though. In early 2021, the platform faced scrutiny for temporarily halting the trading of certain volatile stocks like GameStop, raising questions about its commitment to the principles of democratization. However, it remains a popular choice among investors for its ease of use and fee-free trading.

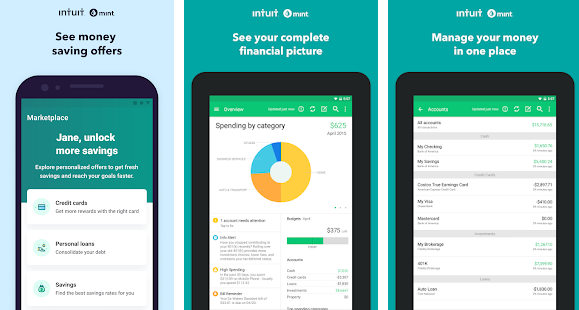

Mint – Master Your Budget

Managing personal finances can be challenging, but Mint makes it easier than ever. This budgeting and expense tracking app provides users with a comprehensive view of their financial health.

- Quick insight: Mint syncs with your bank accounts, credit cards, and other financial institutions, allowing you to see all your financial information in one place. This streamlines the process of tracking income and expenses. By categorizing transactions, Mint provides insights into your spending habits, making it easier to create and stick to a budget.

- Set you budget: One of Mint’s standout features is its ability to create customized budgets based on your spending history and financial goals. It sends alerts when you approach or exceed your budget in specific categories, helping you avoid overspending. The app also offers a bill tracking feature, ensuring you never miss a payment deadline.

- Credit score: For those looking to improve their credit score, Mint provides free credit score monitoring. You can keep an eye on your credit score and receive personalized tips on how to improve it. This feature is a valuable addition for anyone looking to build or maintain good credit.

Mint’s success lies in its simplicity and comprehensiveness. It’s a must-have app for individuals who want to take control of their finances, understand their spending patterns, and work toward their financial goals with confidence.

PayPal – Streamline Payments

PayPal is a fintech pioneer that has been at the forefront of digital payments for years. This versatile app empowers individuals and businesses to send and receive money securely.

- Online payments: One of the primary uses of PayPal is online payments. Whether you’re shopping online or splitting a bill with friends, PayPal offers a convenient and secure way to complete transactions. You can link your bank account, credit cards, or even use your PayPal balance to make payments.

- Fund transfer: But PayPal’s functionality goes beyond payments. The app allows you to transfer funds to others instantly, making it an excellent choice for sending money to family and friends, especially when you need to split costs or share expenses. It also offers a “Request Money” feature that simplifies the process of collecting payments from others.

- Digital currencies: In recent years, PayPal has embraced the cryptocurrency boom. Users can now buy, hold, and sell cryptocurrencies like Bitcoin, Ethereum, and Litecoin through the app. This integration of cryptocurrencies into a mainstream financial app has significantly contributed to the adoption of digital currencies.

- Easy to pay: Additionally, PayPal’s Venmo, a peer-to-peer payment service, has become immensely popular among millennials and Gen Z. Venmo makes it easy to split bills, pay for services, and share expenses with friends, all while adding a social element to transactions.

Overall, PayPal’s range of services, ease of use, and security measures make it a go-to fintech app for managing payments and finances.

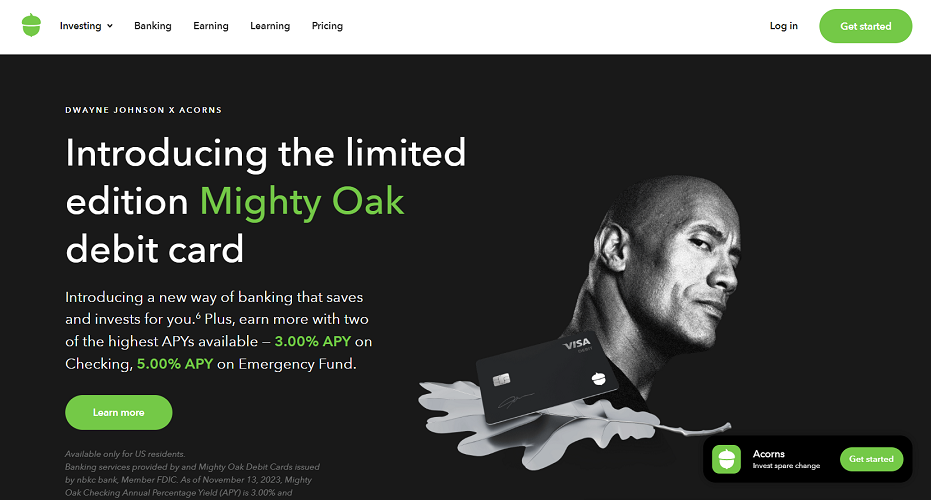

Acorns – Invest Your Spare Change

Investing for the future can be daunting, especially if you have limited funds to spare. Acorns addresses this challenge by offering a unique micro-investing approach.

- Simple yet powerful: It rounds up your everyday purchases to the nearest dollar and invests the spare change in a diversified portfolio. This automatic savings and investment feature make it painless to start building wealth, even if you don’t have a lot of money to spare.

- Fianacial portfolios: The app offers several investment portfolios based on your risk tolerance and financial goals, making it accessible for both conservative and aggressive investors. Additionally, Acorns provides retirement account options, helping users save for their long-term financial security.

- Educational component: It offers articles and tips on saving and investing, making it a valuable resource for individuals who are new to the world of investing. This educational aspect sets it apart from traditional savings accounts, where your money might grow very slowly due to low-interest rates.

It’s designed to make investing more accessible and manageable, particularly for individuals who might not have significant amounts of money to invest upfront.

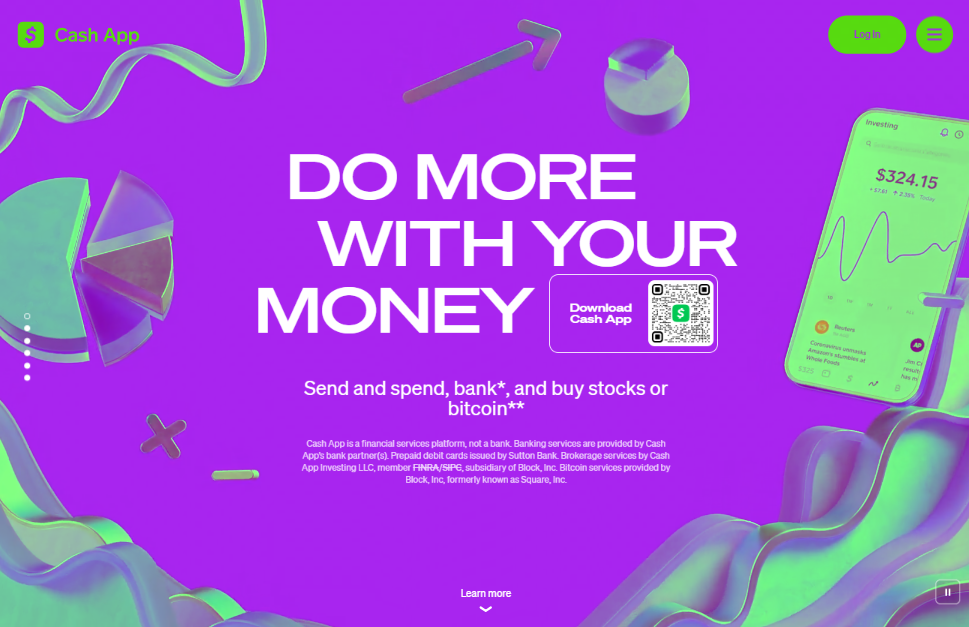

Cash App – Simplify Peer-to-Peer Payments

Cash App is a popular fintech app developed by Square, Inc. It offers a variety of financial services and features, ranging from peer-to-peer payments to investment options.

- Peer-to-peer payments: The app’s core feature is the ability to send and receive money from friends and family instantly. Whether you’re splitting a restaurant bill, paying rent, or chipping in for a group gift, Cash App simplifies the process. Users can link their debit cards or bank accounts to the app to facilitate these transactions.

- Cash card: This is a customizable debit card linked to your Cash App balance. You can use it to make purchases at retailers that accept Visa, and even withdraw cash from ATMs. The Cash Card provides a physical representation of your digital funds, enhancing the flexibility of the app.

- Cash app bitcoin: Cash App also enables users to buy and sell Bitcoin, further embracing the world of cryptocurrencies. This feature aligns with the growing interest in digital currencies and makes it easy for users to dip their toes into crypto investing.

Square Cash has gained immense popularity for its simplicity and convenience when it comes to peer-to-peer payments.

Coinbase – The Crypto Gateway

The cryptocurrency revolution has captured the world’s attention, and Coinbase serves as a gateway for millions of users to enter this exciting and volatile market.

- Cryptocurrency trading: Coinbase is one of the most widely used platforms for buying, selling, and storing cryptocurrencies like Bitcoin, Ethereum, and Litecoin. The app’s popularity is driven by its user-friendly interface and robust security measures.

- User-friendly interface: Coinbase is known for its easy-to-use interface, making it accessible to both beginners and experienced traders in the cryptocurrency space.

- Secure wallets: Coinbase provides online wallets for storing cryptocurrencies. Users can choose between hot wallets for frequent trading and cold wallets for added security.

- Cryptocurrency education: Coinbase Earn is an educational platform where users can learn about different cryptocurrencies and earn a small amount of cryptocurrency for completing educational tasks.

For newcomers to the world of cryptocurrencies, Coinbase offers an ideal starting point. The app provides a straightforward process for buying and selling digital currencies. You can link your bank account or credit card to fund your Coinbase account.

Betterment – Automated Investing

Betterment is at the forefront of the robo-advisor revolution, which combines advanced algorithms with human expertise to simplify the investment process. Here’s how it works:

- Personalized portfolios: Betterment tailors a diversified portfolio to your specific financial goals, risk tolerance, and time horizon. This ensures that your investments align with your unique objectives, whether it’s saving for retirement, a home, or general wealth-building.

- Tax-Efficient investing: One standout feature of Betterment is tax-loss harvesting. It strategically sells investments that have incurred losses to offset gains, potentially reducing your tax liability. This tax-efficient approach can help you keep more of your returns.

- Retirement planning: Betterment provides robust retirement planning tools that help you set and achieve your retirement goals. It calculates how much you need to save and offers guidance on the ideal asset allocation to reach your objectives.

It’s designed to provide users with a simple and convenient way to invest for their financial goals while also offering personalized advice.

Chime – Modern Banking

Chime is part of the growing trend of neobanks, also known as challenger banks, that are redefining traditional banking services. Here’s what makes Chime a modern banking solution:

- No hidden fees: Chime is known for its transparency and absence of hidden fees. There are no monthly maintenance fees, minimum balance requirements, or overdraft fees, making it an affordable choice for users.

- Early direct deposit: Chime provides access to your paycheck up to two days earlier than traditional banks through its Early Direct Deposit feature. This can be a significant advantage for managing your finances.

- Automatic savings: Chime encourages saving through its “Save When You Get Paid” feature. With every direct deposit, you can opt to automatically transfer a percentage of your income into your savings account.

This app offers a range of online banking services with a focus on providing a user-friendly experience, low fees, and features designed to help users manage their finances.

SoFi – Financial Wellness Platform

SoFi is more than just a financial app; it’s a comprehensive platform that offers a wide range of financial products and services. Here’s what makes SoFi unique:

- Financial product suite: SoFi covers various aspects of your financial life. Whether you’re looking to refinance student loans, obtain a mortgage, or invest for your future, SoFi has you covered.

- Comprehensive financial overview: SoFi’s app provides a holistic view of your finances, giving you insights into your income, expenses, debts, and investments. This comprehensive perspective enables better financial decision-making.

- Debt repayment tools: SoFi offers tools and resources to help you pay off debt more efficiently. This includes strategies for managing and refinancing student loans, personal loans, and credit card debt.

This app offers a variety of financial products and services, including lending, investing, banking, and financial planning.

Stash – Invest in Your Interests

Stash takes a unique approach to investing by focusing on your interests and values. Here’s how Stash makes investing more accessible and engaging:

- Personalized investment selection: Stash allows you to choose investments based on your interests, beliefs, and goals. You can invest in companies and industries that resonate with you, such as technology, clean energy, or socially responsible businesses.

- Educational content: Stash offers a library of educational content to help you understand the world of investing better. This is particularly helpful for newcomers to the world of finance.

- Fractional shares: Stash enables you to invest in fractional shares of stocks and exchange-traded funds (ETFs). This means you can start investing with as little as $5, making it accessible to virtually anyone.

It’s designed to help individuals build portfolios with small amounts of money and provides educational tools to enhance financial literacy.

Conclusion

The fintech revolution has given us an abundance of tools to take control of our financial lives. These top 10 best fintech apps cater to different aspects of personal finance, from investing and budgeting to payments and banking. By integrating these apps into your financial routine, you can save time, make more informed decisions, and work toward your financial goals with greater ease.

As we delve into these best fintech apps, it’s crucial to recognize how they not only reflect the current landscape but also serve as indicators of the top fintech trends shaping the future of fintech. Remember, the right fintech app for you depends on your specific needs and goals. Whether you’re a seasoned investor, a budget-conscious spender, or someone looking to explore the world of cryptocurrencies, there’s a fintech app out there to suit your needs. Embrace the digital financial revolution and take charge of your financial future with these innovative apps.